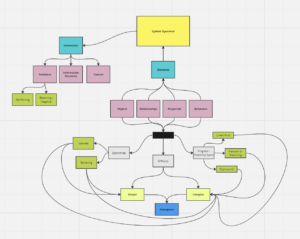

My group is working on a game that models the credit score system. The values in our game are financial “responsibility” and fairness, which are in tension within the credit score system. We are hoping to provide a game that conveys important information about how credit scores are calculated, how important life decisions can impact those scores, and how the system can present unfair barriers to those with lower incomes.

Loops

The primary loop is a monthly credit billing and salary payment cycle, which is established through the game board. As players progress through the loops, they encounter opportunities (e.g., buy a house) and events (e.g., unexpected medical bills) that induce them to spend money, affecting their credit utilization and ability to pay at the end of the month.

Arcs

An arc we are exploring after playtesting our prototype is a buy/sell arc for properties. We initially only allowed players to buy assets and pay them off, but, to induce more player interaction, we’re thinking to allow players to sell assets to other players in order to reduce their credit utilization and acquire cash needed to make payments.

We are also adding a loan payment arc. Any loan a player takes will have a certain number and value of payments needed to pay that loan off in the most beneficial way for a player’s credit score. When a player makes a monthly payment, the place a token on their loan card. When they have the required number of tokens noted on the card, the loan is paid off and they reap the benefits to their credit score. Failure to pay off loans on schedule has a negative impact for their credit scores.

These arcs don’t exactly lead into or out of the main loop but occur within a single loop or across multiple loops.