The game I played for this week’s critical play is trading zero days to expiration options, or 0DTE for short. Options are a type of financial instrument that allows one to buy or sell shares of a stock at a fixed price until some expiry date. 0DTE options expire at the end of the current day, meaning one can see the outcome of their play within the day. In recent years, 0DTEs have become increasingly popular as a casino game for people to gamble away their paychecks or savings. Options were invented by Russell Sage in the late 19th century. Today, people can very easily buy or sell options via brokers like Robinhood, which is available on iOS, Android, and web. I played the game on Schwab.

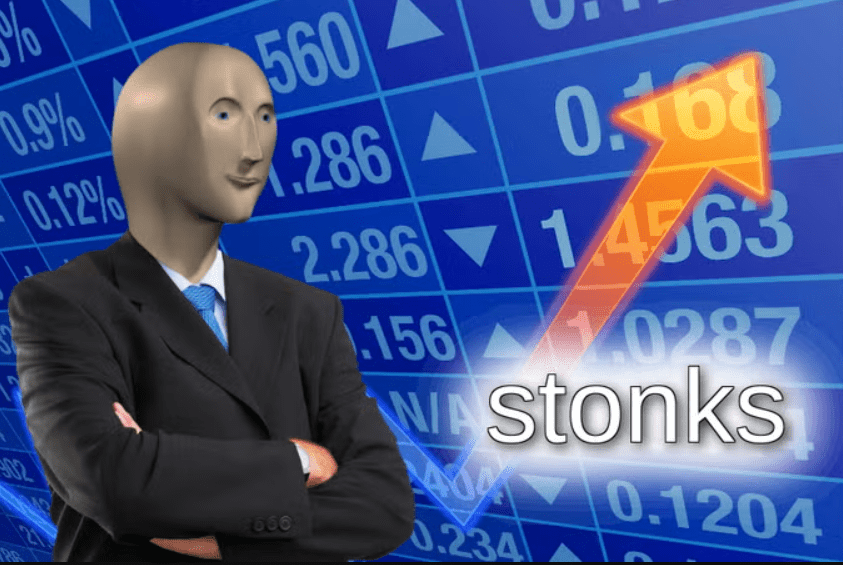

Trading 0DTEs is an addictive game that effectively makes use of randomness to keep players hooked. The loop of trading 0DTEs is simple yet addictive. One would find a stock or ETF with options expiring on the current day, and can either buy a call option or a put option. If they buy a call option, they will make money if the stock price goes up by the end of the day. If they buy a put option, they make money if the stock price goes down. Otherwise, they lose all the money they put in. Compared to other types of more boring trading, 0DTEs have very quick feedback, as results are determined by the end of the day. This allows for instant gratification and satisfies players’ psychological need for information. The availability of live price data at all times also makes the game engaging for players. Unlike a lottery game like Powerball where the player has nothing to do between buying the lottery and the time the results are announced, in the case of 0DTEs, the player can be glued to the screen to monitor the price’s every move throughout the day, creating the emotion of thrill as the price moves in favor of or against the player’s position.

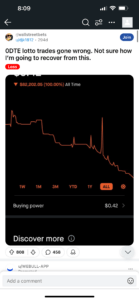

The unique way that randomness is used in 0DTE options also makes it more addictive. Due to the complex math behind options, it is very hard for the player to determine the exact probability of winning and the size of potential winnings. However, there is always a tiny chance of hitting the “jackpot” and 10x or even 100x one’s money. The allure of the chance to become an overnight millionaire constantly draws people in even after many losses. The obfuscation of exact probabilities and elusive chance for jackpot makes the game more addictive, as players forget or don’t realize that they are playing a game with negative EV.

Another way the game is addictive is because of the various design choices of the brokerage platforms that appeal to the aesthetic of sensation. This is most prominent in Robinhood, which utilizes effects like confetti when completing a trade and makes users mimic the motion of scratching off a lottery ticket when claiming their reward stock. Compared to other brokers, Robinhood’s UI is almost like a slot machine, as it uses an abnormally bright color scheme and allows users to place trade extremely easily, by just a single swipe up the screen instead of having to set prices and order type manually. These design choices nudge users to treat the app like a game and get them to keep coming back. In fact, earlier this year, Robinhood had to pay 7.5 million dollars in a lawsuit for the “gamification” practices of their trading platform.

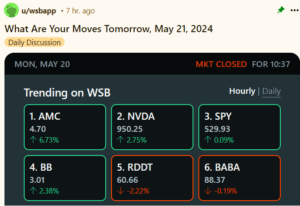

Compared to other games of chance like Poker or Blackjack, trading 0DTEs has a very small skill factor. Instead, this is a game that almost entirely relies on luck. That does not stop people from believing that their wins come from skills, however. Scrolling through r/wallstreetbets, we can easily find many who think they have a knack at picking the right directions after a few lucky wins. The false sense of skill creates satisfaction through competence under the self-determination theory and appeals to players’ psychological need for achievement.

Another difference between 0DTEs and other games of chance is the significantly higher upper limit that one can bet on this game. While traditional casino games like roulette have table limits, 0DTEs allow one to gamble as much money as they would like on a single play. The lack of a meaningful upper limit on betting helps to create the framework of YOLO, where one would gamble all or a significant amount of one’s net worth on a single trade, in hopes of making it big overnight. Most people fail, but those who do succeed, or who see other people’s successes, keep coming back again and again until they lose all of their winnings.